Introduction: The Only Certainty Is Uncertainty

Markets shift overnight. Supply chains fail. Consumer demand whiplashes.

For CFOs and strategy leaders, uncertainty isn’t a temporary crisis — it’s the operating environment.

The winners? Organizations that build resilience: the ability to absorb shocks, adapt, and gain ground while competitors stumble.

What Business Resilience Really Means

Business resilience goes beyond risk management. It’s about creating systems that bend without breaking — and bounce back stronger.

Resilient companies share three dimensions:

- Financial Flexibility → Liquidity runway, agile cost structures.

- Operational Agility → Diversified suppliers, digitized workflows.

- Strategic Clarity → Scenario simulations, early-warning dashboards, decisive leadership.

📊 Proof Point: McKinsey research shows resilient companies deliver 10% higher shareholder returns during downturns.

Framework: The Resilience Triangle

| Dimension | Key Question | Benchmark / Best Practice |

|---|---|---|

| Financial | Can we fund operations if revenue drops? | 3–6 months liquidity runway |

| Operational | Can we adapt quickly to disruption? | ≤30% reliance on any one supplier/customer |

| Strategic | Can leadership pivot decisively? | Run quarterly scenario simulations |

Myth vs Reality of Resilience

| Myth | Reality |

|---|---|

| Resilience = cost-cutting | The most resilient firms invest in innovation during downturns. |

| Culture doesn’t matter | Adaptable culture is the #1 predictor of resilience. |

| Risk management is enough | Resilience prepares for the unknown, not just the known. |

Quick Wins (30 Days)

- Run a Cash Stress Test → Simulate a 20% revenue drop.

- Map Supplier Dependencies → Flag single points of failure.

- Set Up a Contingency Dashboard → Monitor leading indicators weekly.

Scaling Plays (60–90 Days)

- Diversify Revenue Streams → Reduce reliance on single markets.

- Cross-Train Talent → Cover critical roles in case of disruption.

- Scenario Planning → Build 3 models: Base, Downside, Upside.

Moat Builders (Long-Term)

- Cultural Resilience → Incentivize adaptability and learning.

- Digital Infrastructure → Predictive analytics + automated reporting.

- Strategic Optionality → Partnerships, innovation budgets, M&A dry powder.

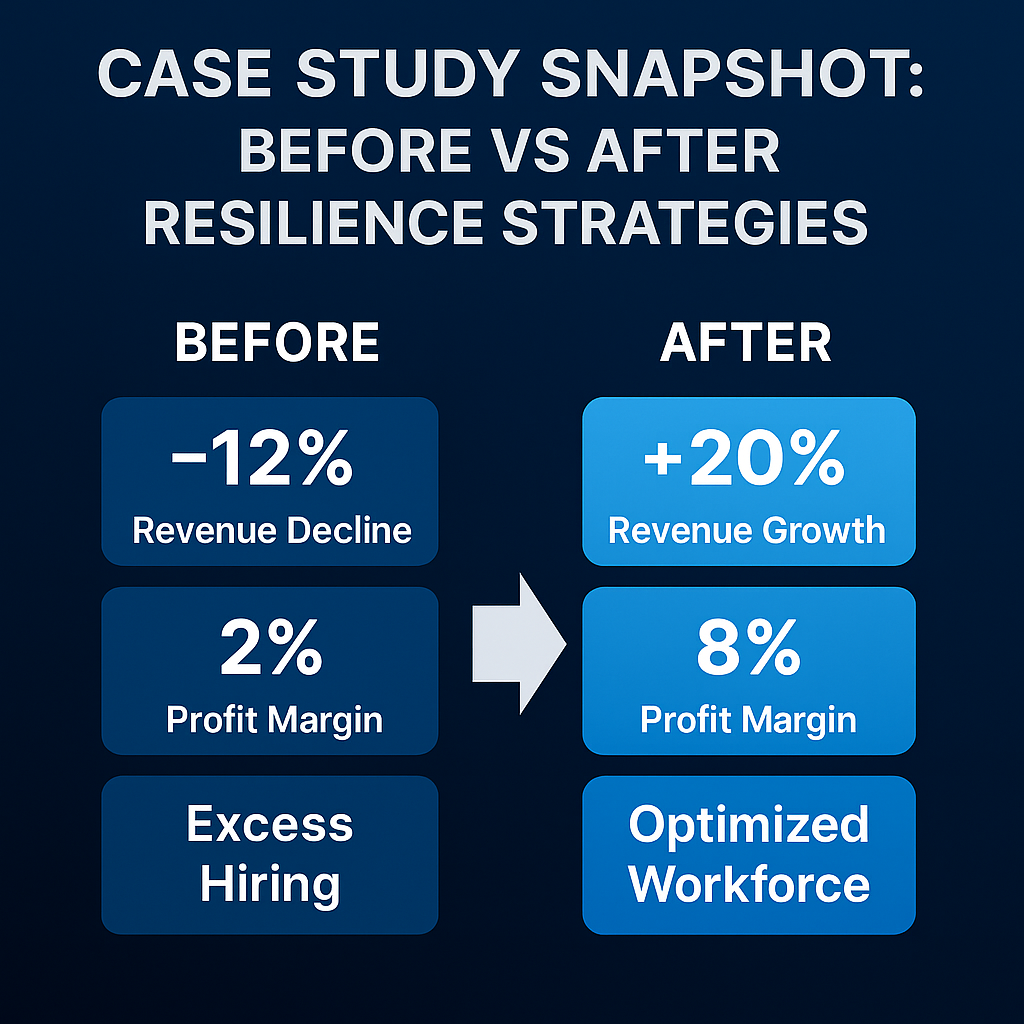

Case Study: CFO Turns Uncertainty Into Edge

A mid-market manufacturer faced volatile swings. By applying resilience frameworks:

- Liquidity runway extended from 3 months → 9 months.

- Supplier concentration cut from 60% → 30%.

- Market share grew by 12% in recovery.

- EBITDA margin improved 3 points.

Result: Instead of surviving turbulence, the CFO positioned the company to grow stronger through it.

FAQs

1. What’s the difference between resilience and risk management?

Risk management addresses known risks; resilience prepares for the unknown.

2. How much liquidity should a company keep?

Generally 3–6 months of operating expenses, adjusted by industry volatility.

3. What role does culture play?

A culture of adaptability is often the strongest predictor of resilience.

4. How does AI help with resilience?

AI identifies early-warning signals and models disruption scenarios faster than manual methods.

Conclusion: Resilience Is Advantage

Uncertainty won’t fade. Leaders who invest in resilience today won’t just endure volatility — they’ll emerge stronger.

👉 Run a 24-hour resilience audit with ActStrategic.ai’s playbooks and stress-test your business before the next disruption.

Want more from ActStrategic.ai?

Consulting Playbooks You Can Run Yourself: Save Costs, Gain Clarity

How to Stop Ad Spend from Burning Without Return

AI Superagency: Redefining Business Strategy in 2026 and Beyond