Introduction

Economic shocks, supply chain disruptions, and rapid technology shifts aren’t once-in-a-decade events anymore—they’re constant. McKinsey reports that 65% of executives expect more frequent disruptions in the next five years than in the last five. For small and mid-sized business (SMB) leaders, resilience is no longer optional—it’s a survival skill.

But what does “business resilience” really mean? It’s not just cutting costs or weathering storms. True resilience is about designing an organization that can adapt, absorb shocks, and seize opportunities faster than competitors.

In this post, we’ll walk through resilience frameworks, benchmarks, ROI math, and playbooks SMB leaders can apply immediately—moving beyond theory into practical, consulting-grade strategy.

The Strategic Case for Resilience

Why Resilience Matters for SMBs

- Market volatility is accelerating: Global shocks are occurring every 3.7 years on average (McKinsey).

- Customer expectations are shifting faster: Digital adoption jumped forward 5 years in just 8 weeks during COVID.

- Capital markets reward resilience: Resilient firms outperformed peers by 10%+ in shareholder returns during downturns.

For SMBs—where a single disruption can erase margin overnight—resilience is not defensive. It’s competitive strategy.

💡 ROI Example: A manufacturer investing $100k in supply chain redundancy (dual sourcing + local backup inventory) avoided $1.2M in lost revenue during a 3-month supplier shutdown. That’s a 12x ROI on resilience investment.

Core Frameworks for Building Business Resilience

1. The Resilience Flywheel Framework

A practical 4-part loop SMBs can implement:

- Anticipate → Scan environment for risks (use PESTLE + scenario planning).

- Case: A SaaS firm ran “what if” scenarios for a 30% drop in subscriptions. When churn spiked during inflation, they had already prepped retention campaigns and reduced cash burn.

- Absorb → Build financial buffers and flexible supply chains.

- Case: A logistics SMB added a 60-day liquidity buffer. When fuel prices jumped 40%, they absorbed the shock without layoffs.

- Adapt → Rapidly pivot strategy, offerings, or operations.

- Case: A retail chain pivoted 20% of staff to e-commerce fulfillment within 6 weeks, saving $750k in lost sales.

- Accelerate → Turn disruption into growth opportunities.

- Case: A construction firm leveraged downtime during a downturn to cross-train crews, emerging more efficient and competitive.

🔑 Benchmark: Gartner found companies with structured resilience playbooks return to growth 2× faster than peers after disruption.

2. Strategic Levers of Organizational Resilience

Using McKinsey’s 7S Framework adapted for resilience:

- Strategy: Build contingency playbooks for demand shocks (e.g., price elasticity, product pivots).

- Structure: Agile teams that reallocate resources within weeks.

- Systems: Early-warning dashboards (cash, pipeline, churn, supply KPIs).

- Skills: Cross-train staff on mission-critical functions.

- Style: Leadership communication that maintains trust during uncertainty.

- Staff: Retention strategies for high-impact roles.

- Shared Values: Culture that prioritizes adaptability over rigidity.

📊 Industry Benchmark: Deloitte’s 2023 survey found 70% of resilient SMBs had crisis-ready, cross-functional teams—versus just 25% of peers.

💡 ROI Example: A professional services firm spent ~$30k on cross-training workshops and avoided ~$200k in lost billables when a senior partner unexpectedly left.

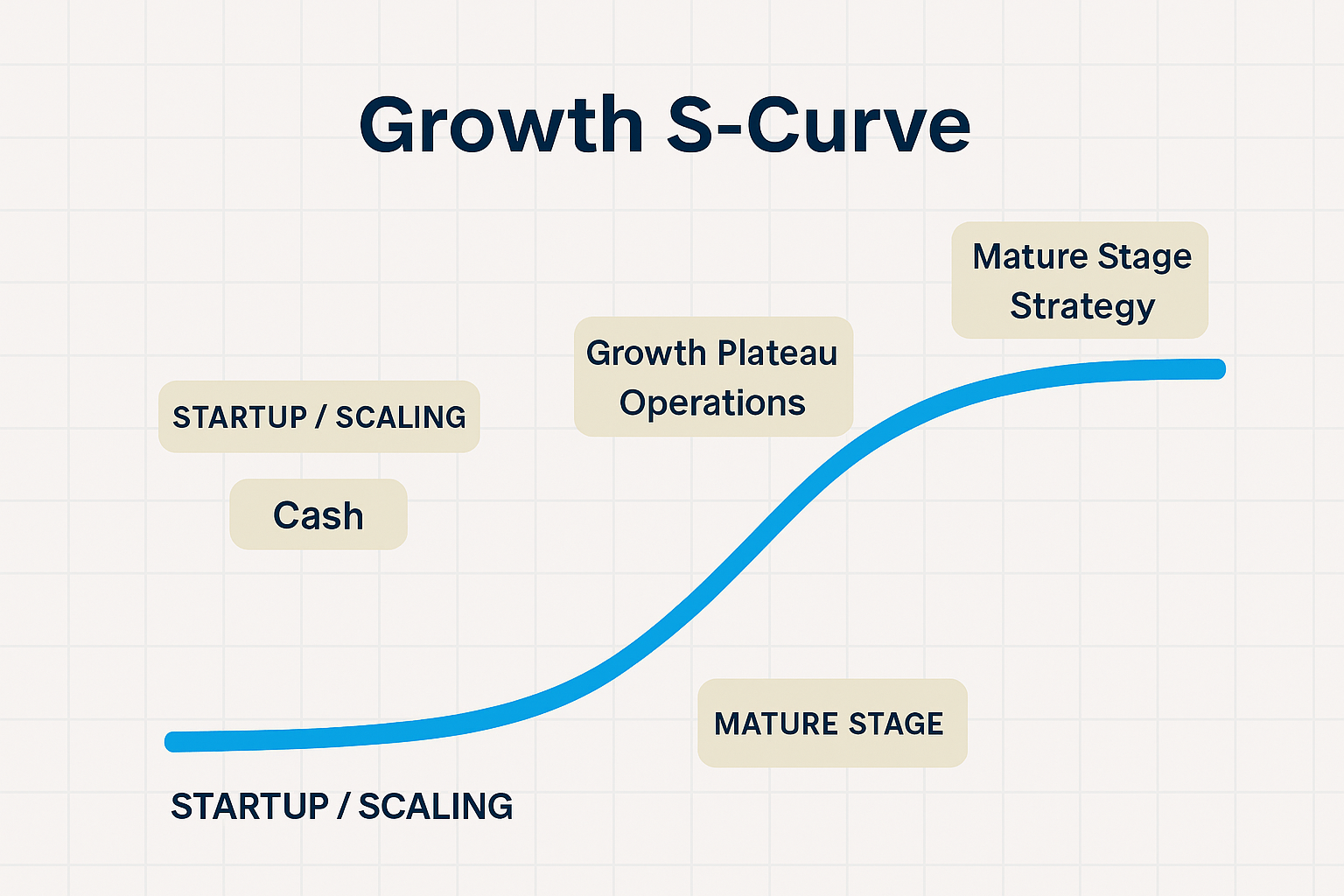

3. Resilience on the Growth S-Curve

Map resilience strategies to growth phases:

- Startup / Scaling:

- Focus: Cash resilience (burn rate, investor diversification).

- Mini-Case: A SaaS startup kept 12 months runway vs. the industry average of 6. When VC funding slowed, they survived without layoffs.

- Growth Plateau:

- Focus: Operational resilience (supply chain, process automation).

- Mini-Case: A regional manufacturer invested $80k in automation. Productivity rose 20%, offsetting wage inflation and protecting margins.

- Mature Stage:

- Focus: Strategic resilience (M&A readiness, innovation pipelines).

- Mini-Case: A mature e-commerce brand built an innovation lab. During a downturn, they launched a subscription box line that lifted LTV by 15%.

🔑 Benchmark: Harvard Business Review found resilient firms not only recover faster but also gain market share during recessions by innovating when competitors retreat.

Quick Wins Box: 5 Actions SMB Leaders Can Take This Quarter

- Establish a 90-day liquidity buffer equal to payroll + fixed costs.

- Create a resilience dashboard with 5 leading indicators (cash, pipeline, churn, supply chain, talent risk).

- Run one scenario planning workshop with your leadership team.

- Cross-train staff on at least two mission-critical processes.

- Document a customer communication protocol for crises.

Case Example: Restaurant Franchise Resilience

A regional restaurant franchise faced a 40% revenue drop during COVID lockdowns. Instead of retrenching:

- Anticipate: Ran scenario plans for 25%, 50%, and 75% drops.

- Absorb: Negotiated rent deferrals + secured $500k line of credit.

- Adapt: Pivoted to curbside pickup + delivery partnerships.

- Accelerate: Launched family meal kits, driving new recurring revenue.

Result: Within 12 months, the franchise returned to profitability and grew revenue by 15% above pre-crisis levels.

Strategic Framework Graphic (for design)

Concept: The Resilience Flywheel

- Center: “Resilient SMB”

- Outer Circle: Anticipate → Absorb → Adapt → Accelerate

- Icons: radar (anticipate), shield (absorb), pivot arrows (adapt), rocket (accelerate).

What’s next?

👉 Want to know where your company stands? Use the AI Readiness & Resilience Playbook at ActStrategic.ai. Our diagnostic tools help SMB leaders benchmark resilience and design a roadmap to thrive—even in uncertainty.

Also explore:

FAQ: Business Resilience for SMB Leaders

Q1. What is organizational resilience strategy?

It’s a structured approach to building financial, operational, and cultural flexibility so businesses can adapt quickly during disruption.

Q2. How do SMBs measure resilience?

Track liquidity ratios, supply chain redundancy, employee adaptability, and customer retention under stress. ActStrategic.ai recommends a 5-metric dashboard.

Q3. Why is resilience different from risk management?

Risk management protects against downside; resilience creates upside by positioning firms to grow faster post-crisis.

Q4. How much should SMBs invest in resilience?

Benchmarks suggest allocating 5–10% of annual operating expenses toward resilience levers (technology, buffers, training).

Q5. Can AI improve business resilience?

Yes—AI enhances resilience through predictive analytics, early-warning dashboards, and faster scenario modeling.

Final Word

Resilience isn’t about survival—it’s about designing your business to thrive in disruption. SMB leaders who embrace resilience frameworks gain not only protection but also strategic advantage.

At ActStrategic.ai, we bring consulting-level playbooks—without the consulting price tag—to help you future-proof your company.